Data Sharing Services in the Field of Payment (ÖHVPS)

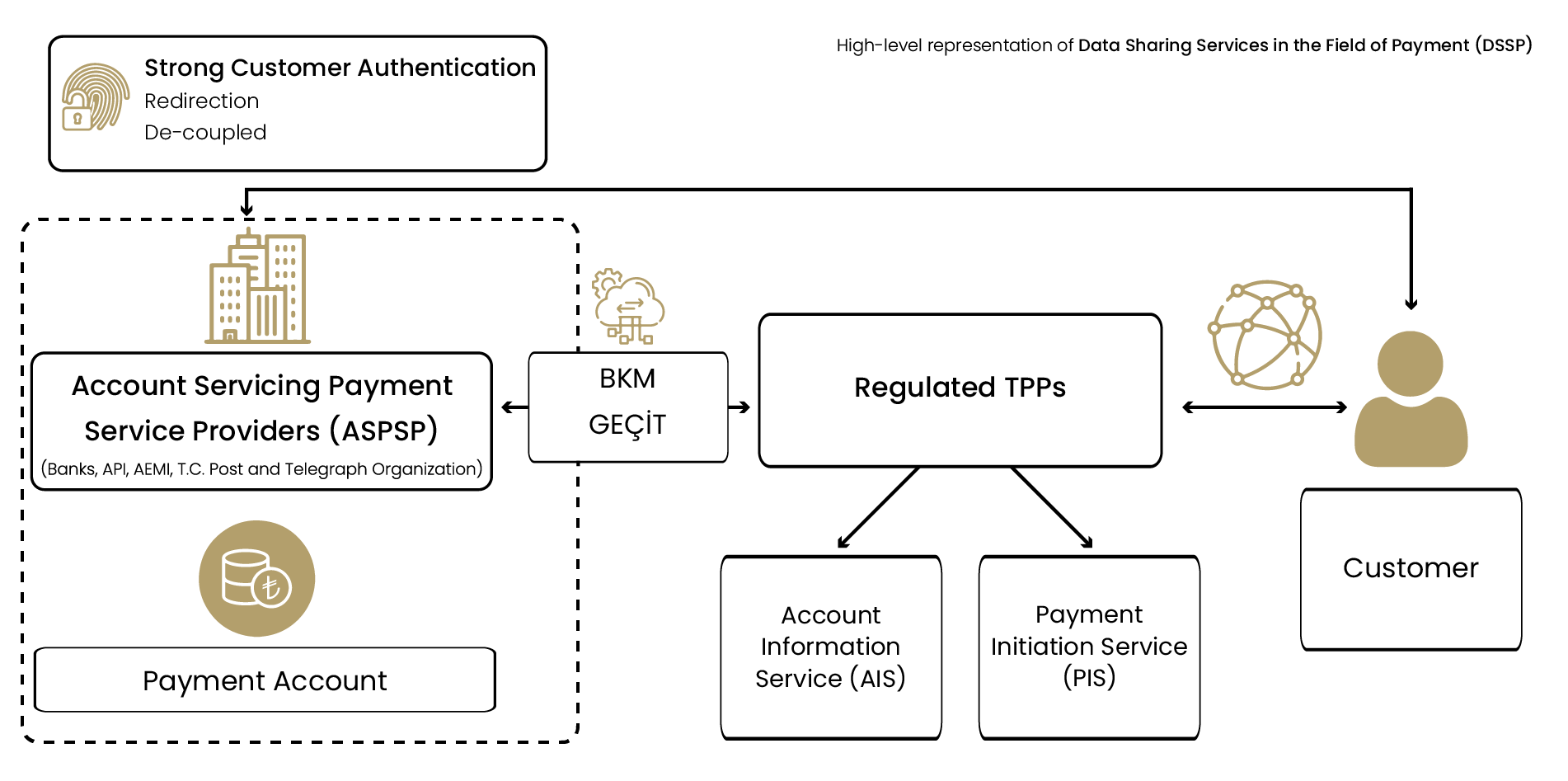

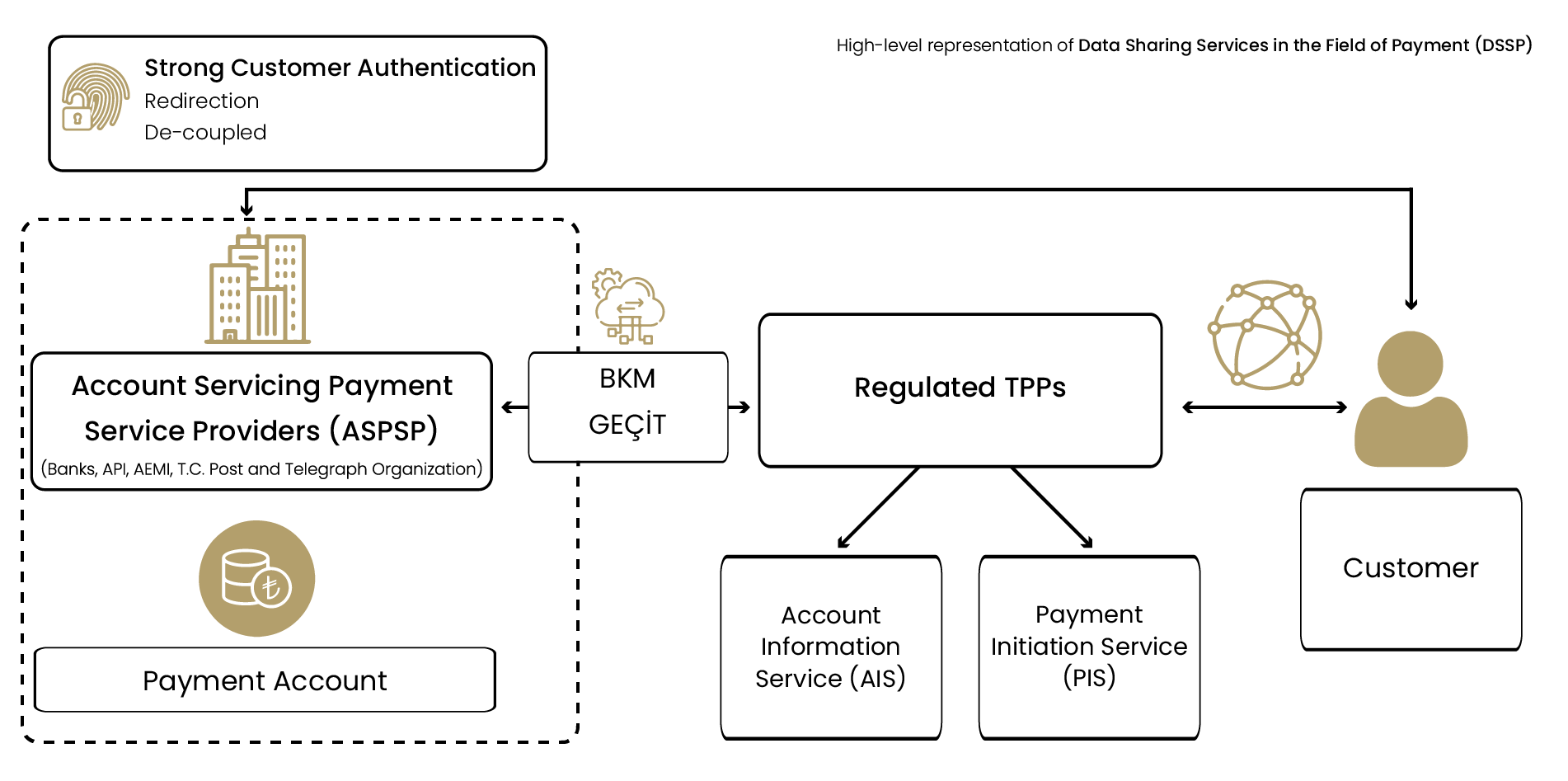

Open Banking refers to the sharing of financial data with authorized third-party service providers (TPPs) in a secure environment, and Data Sharing Services in the Field of Payment include two essential services defined under the payment domain within the Open Banking framework.

What is Open Banking?

- Open Banking is the process of making data in the financial system accessible to authorized TPPs through standard Application Programming Interfaces (APIs) in compliance with established regulations.

What is Data Sharing Services in the Field of Payment (DSSP)?

Under DSSP, two essential services are defined for the payments area, which falls under the authority and responsibility of the Central Bank of the Republic of Turkey (CBRT):

- Payment Initiation Services: The service that allows initiating a payment order related to a payment account held at another payment service provider, upon the request of the payment service user (PSU) [Article 12, paragraph 1, subparagraph (f)].

- Account Information Services: The service that provides consolidated information on one or more payment accounts held by the PSU at payment service providers, presented on online platforms, with the user’s consent [Article 12, paragraph 1, subparagraph (g)].

What is the Purpose of DSSP?

- Within the DSSP framework, authorized TPPs can offer PSUs the ability to perform transactions faster, at lower costs, and with a better user experience through innovative financial services developed in a competitive environment. At the same time, financial institutions can make their existing core services more widely accessible and tailored to customer needs through authorized TPPs.

The two essential services defined for the payments domain under DSSP:

The basic principles for DSSP under the Regulation Provisions are as follows:

ASPSPs are required to provide Data Sharing Services in the Field of Payment to AISPs and PISPs.

- In the payment initiation service, the parties involved are the PISPs and the ASPSPs.

- In the account information service, the parties involved are the AISPs and the ASPSPs.

- Strong Customer Authentication (SCA) must be performed for the PSU at the ASPSP in DSSP, and the PSU can use the services if the payment account is accessible online.

-

Participants of DSSP and Participants Who Completed the DSSP Certification Process

| ASPSPs (Banks) |

| 1 |

Akbank T.A.Ş. |

| 2 |

Aktif Yatırım Bankası A.Ş. |

| 3 |

Albaraka Türk Katılım Bankası A.Ş. |

| 4 |

Alternatifbank A.Ş. |

| 5 |

Anadolubank A.Ş. |

| 6 |

Arap Türk Bankası A.Ş. |

| 7 |

Burgan Bank A.Ş. |

| 8 |

Denizbank A.Ş. |

| 9 |

Dünya Katılım Bankası A.Ş. |

| 10 |

Enpara Bank A.Ş. |

| 11 |

Fibabanka A.Ş. |

| 12 |

Golden Global Yatırım Bankası A.Ş. |

| 13 |

HSBC Bank A.Ş. |

| 14 |

ING Bank A.Ş. |

| 15 |

Kuveyt Türk Katılım Bankası A.Ş. |

| 16 |

Misyon Yatırım Bankası A.Ş. |

| 17 |

ODEA Bank A.Ş. |

| 18 |

Posta ve Telgraf Teşkilatı A.Ş. |

| 19 |

QNB Bank A.Ş. |

| 20 |

Q Yatırım Bankası |

| 21 |

Şekerbank T.A.Ş. |

| 22 |

T.O.M. Katılım Bankası A.Ş. |

| 23 |

TurkishBank A.Ş. |

| 24 |

Türk Ekonomi Bankası A.Ş. |

| 25 |

Türkiye Cumhuriyeti Ziraat Bankası A.Ş. |

| 26 |

Türkiye Emlak Katılım Bankası A.Ş. |

| 27 |

Türkiye Finans Katılım Bankası A.Ş. |

| 28 |

Türkiye Garanti Bankası A.Ş. |

| 29 |

Türkiye Halk Bankası A.Ş. |

| 30 |

Türkiye İş Bankası A.Ş. |

| 31 |

Türkiye Vakıflar Bankası T.A.O. |

| 32 |

Vakıf Katılım Bankası A.Ş. |

| 33 |

Yapı ve Kredi Bankası A.Ş. |

| 34 |

Ziraat Katılım Bankası A.Ş. |

| ASPSPs (Regulated TPPs – Payment Institutions) |

| 1 |

Ahlatcı Ödeme ve Elektronik Para Hizmetleri A.Ş. |

| 2 |

Aköde Elektronik Para ve Ödeme Hizmetleri A.Ş |

| 3 |

Lydians Elektronik Para ve Ödeme Hizmetleri A.Ş. |

| 4 |

Payporter Ödeme Hizmetleri ve Elektronik Para A.Ş. |

| 5 |

Turkcell Ödeme ve Elektronik Para Hizmetleri A.Ş. |

| Regulated AISPs and PISPs (Banks) |

| 1 |

Akbank T.A.Ş. |

| 2 |

Aktif Yatırım Bankası AŞ. |

| 3 |

Albaraka Türk Katılım Bankası A.Ş. |

| 4 |

Anadolubank A.Ş. |

| 5 |

Denizbank A.Ş. |

| 6 |

Enpara Bank A.Ş. |

| 7 |

Fibabanka A.Ş. |

| 8 |

Golden Global Yatırım Bankası A.Ş. |

| 9 |

ING Bank A.Ş. |

| 10 |

Kuveyt Türk Katılım Bankası A.Ş. |

| 11 |

Misyon Yatırım Bankası A.Ş. |

| 12 |

ODEA Bank A.Ş. |

| 13 |

QNB Bank A.Ş. |

| 14 |

Şekerbank T.A.Ş. |

| 15 |

Türk Ekonomi Bankası A.Ş. |

| 16 |

Türkiye Cumhuriyeti Ziraat Bankası A.Ş. |

| 17 |

Türkiye Finans Katılım Bankası A.Ş. |

| 18 |

Türkiye Garanti Bankası A.Ş. |

| 19 |

Türkiye Halk Bankası A.Ş. |

| 20 |

Türkiye İş Bankası A.Ş. |

| 21 |

Türkiye Vakıflar Bankası T.A.O. |

| 22 |

Vakıf Katılım Bankası A.Ş. |

| 23 |

Yapı ve Kredi Bankası A.Ş. |

| 24 |

Ziraat Katılım Bankası A.Ş. |

| Regulated TPPs (Payment Institutions) |

| |

|

PISP |

AISP |

| 1 |

Aköde Elektronik Para ve Ödeme Hizmetleri A.Ş |

√ |

√ |

| 2 |

D Ödeme Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 3 |

Halk Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 4 |

Moka United Ödeme Hizmetleri Ve Elektronik Para Kuruluşu A.Ş. |

√ |

√ |

| 5 |

N Kolay Ödeme ve Elektronik Para Kuruluşu A.Ş. |

√ |

√ |

| 6 |

Octet Express Ödeme Kuruluşu A.Ş. |

√ |

√ |

| 7 |

Qpay Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 8 |

SBM Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 9 |

Sipay Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 10 |

Trend Ödeme Kuruluşu A.Ş. |

√ |

√ |

| 11 |

Turk Elektronik Para A.Ş. |

√ |

√ |

| 12 |

Turkcell Ödeme ve Elektronik Para Hizmetleri A.Ş. |

√ |

√ |

| 13 |

Turkonay Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 14 |

Vakıf Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 15 |

Sender Ödeme Hizmetleri A.Ş. |

√ |

√ |

| Regulated TPPs with Payment Institution Status that have completed BKM Technical Certification |

PISP |

AISP |

| 1 |

1000 Ödeme Hizmetleri Ve Elektronik Para A.Ş. |

√ |

√ |

| 2 |

BRQ Link Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 3 |

GönderAl Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 4 |

Halk Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 5 |

HangiPara Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 6 |

İgor Ödeme Kuruluşu A.Ş. |

√ |

√ |

| 7 |

İyzi Ödeme ve Elektronik Para Hizmetleri A.Ş. |

√ |

√ |

| 8 |

Kobaküs Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 9 |

Lidio Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 10 |

Logo Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 11 |

Ödeal Ödeme Kuruluşu A.Ş. |

√ |

√ |

| 12 |

Ozan Elektronik Para A.Ş. |

√ |

√ |

| 13 |

Paratika Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 14 |

QNBpay Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 15 |

Sağlam Ödeme ve Elektronik Para Hizmetleri A.Ş. |

√ |

√ |

| 16 |

Sender Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 17 |

Token Ödeme Hizmetleri ve Elektronik Para A.Ş. |

√ |

√ |

| 18 |

Türk Hava Yolları Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |

| 19 |

Timsis Ödeme Hizmetleri ve Elektronik Para A.Ş. |

√ |

√ |

| 20 |

Vomsis Ödeme Kuruluşu A.Ş. |

√ |

√ |

| 21 |

Ziraat Finansal Teknolojiler Elektronik Para ve Ödeme Hizmetleri A.Ş. |

√ |

√ |