Request to Pay

What is Request to Pay (Öİ) ?

Request to Pay (Öİ) System is a value-added service that aims to improve customers’ usage experiences in the Instant and Continuous Transfer of Funds (FAST) System.

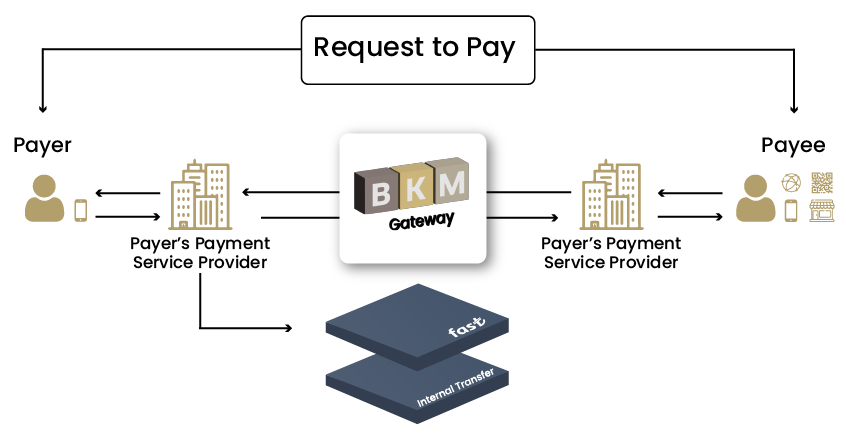

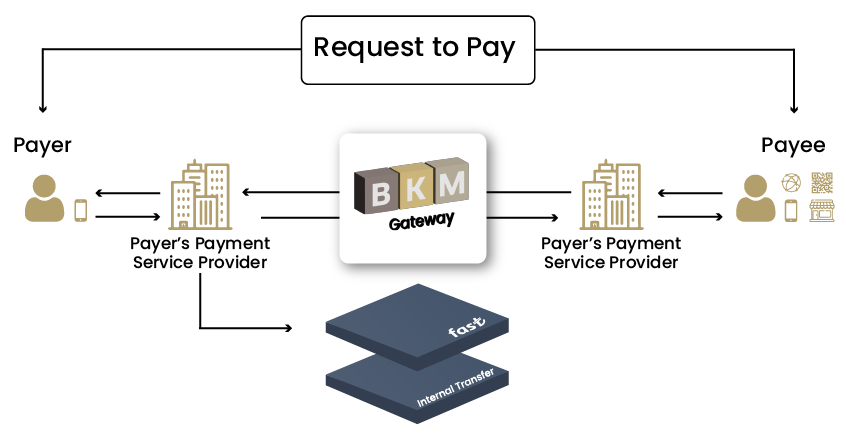

The Request to Pay System is based on the principle that the payee customer requests payment from the payer customer, and the payer customer responds to this request.

Role of BKM in the Request to Pay (Öİ) System:

BKM is the operator of the Request to Pay (Öİ) System among Payment Service Providers.

Request to Pay (Öİ) Flow;

The Payment Request created is realized by checking the PSPs to which the relevant accounts of the parties are linked.

BKM acts as the operator of the Request to Pay System among the relevant PSPs.

Individuals or institutions receive payment request information via instant notification and receive a response regarding payment.

Depending on the response given, the payment is triggered and directed to the appropriate payment system.

-

Participants in the Production Environment

| 1 |

Ahlatçı Ödeme ve Elektronik Para Hizmetleri A.Ş. |

| 2 |

Akbank T.A.Ş. |

| 3 |

Aktif Yatırım Bankası A.Ş. |

| 4 |

Albaraka Türk Katılım Bankası A.Ş. |

| 5 |

Alternatif Bank A.Ş. |

| 6 |

Anadolubank A.Ş. |

| 7 |

BELBİM Elektronik Para ve Ödeme Hizmetleri A.Ş. |

| 8 |

Burgan Bank A.Ş. |

| 9 |

Denizbank A.Ş. |

| 10 |

Dünya Katılım Bankası A.Ş. |

| 11 |

Enpara Bank A.Ş. |

| 12 |

Fibabanka A.Ş. |

| 13 |

Golden Global Yatırım Bankası A.Ş. |

| 14 |

Hayat Finans Katılım Bankası A.Ş. |

| 15 |

ING Bank A.Ş. |

| 16 |

Kuveyt Türk Katılım Bankası A.Ş. |

| 17 |

Lydians Elektronik Para ve Ödeme Hizmetleri A.Ş. |

| 18 |

Misyon Yatırım Bankası A.Ş. |

| 19 |

Moka United Ödeme Hizmetleri Ve Elektronik Para Kuruluşu A.Ş |

| 20 |

Odea Bank A.Ş. |

| 21 |

Parolapara Elektronik Para ve Ödeme Hizmetleri A.Ş. |

| 22 |

Posta ve Telgraf Teşkilatı Anonim Şirketi |

| 23 |

QNB Bank A.Ş. |

| 24 |

Şekerbank A.Ş. |

| 25 |

Sipay Elektronik Para ve Ödeme Hizmetleri A.Ş. |

| 26 |

TOM Katılım Bankası A.Ş. |

| 27 |

Türk Ekonomi Bankası A.Ş. |

| 28 |

Turk Elektronik Para A.Ş. |

| 29 |

Turkcell Ödeme ve Elektronik Para Hizmetleri A.Ş. |

| 30 |

Türkiye Cumhuriyeti Ziraat Bankası A.Ş. |

| 31 |

Türkiye Emlak Katılım Bankası A.Ş. |

| 32 |

Türkiye Finans Katılım Bankası A.Ş. |

| 33 |

Türkiye Garanti Bankası A.Ş. |

| 34 |

Türkiye Halk Bankası A.Ş. |

| 35 |

Türkiye İş Bankası A.Ş. |

| 36 |

Türkiye Vakıflar Bankası T.A.O. |

| 37 |

Vakıf Katılım Bankası A.Ş. |

| 38 |

Yapı ve Kredi Bankası A.Ş. |

| 39 |

Ziraat Dinamik Bankası A.Ş. |

| 40 |

Ziraat Katılım Bankası A.Ş. |

You can find detailed information about the Request to Pay System via the link.