Domestic Clearing and Settlement (YTH) System

Products and Services

- TROY

- BKM Express

- Domestic Clearing and Settlement (YTH) System

- Other Clearing and Settlement Services

- Routing Services

- Proxy Addressing (KOLAS)

- Databases / Management Systems

- Public Debt Collection Solutions

- TR QR Code

- Payment Solutions

- Bankalararası Kart Merkezi (BKM) Academy

- Data Sharing Services in the Field of Payment (ÖHVPS)

- Request to Pay

- Escrow Overlay Service (GÖİ)

- Other Services

Products and Services

- TROY

- BKM Express

- Domestic Clearing and Settlement (YTH) System

- Other Clearing and Settlement Services

- Routing Services

- Proxy Addressing (KOLAS)

- Databases / Management Systems

- Public Debt Collection Solutions

- TR QR Code

- Payment Solutions

- Bankalararası Kart Merkezi (BKM) Academy

- Data Sharing Services in the Field of Payment (ÖHVPS)

- Request to Pay

- Escrow Overlay Service (GÖİ)

- Other Services

Domestic Clearing and Settlement (YTH) System

-

What is Domestic Clearing and Settlement (YTH) System?

YTH system provides a system for clearing and settlement operations of domestic transactions, where one participant’s card used in another participant’s POS or ATM. YTH System Participiants send the transaction records to the System and records are cleared, netted multilaterally and settled by the System.

-

Who is responsible for YTH System?

BKM is responsible from Domestic Clearing and Settlement System. As published in The Official Gazette on 19 June 2015, Central Bank gave official authorization to BKM as a Payment System Operator.

BKM has the administirative supervision right and can take immediate action to keep the System operate without interruption. BKM informs the Participants about the precautions that will be taken.

-

When was YTH System launched?

YTH System was launched in 1991.

-

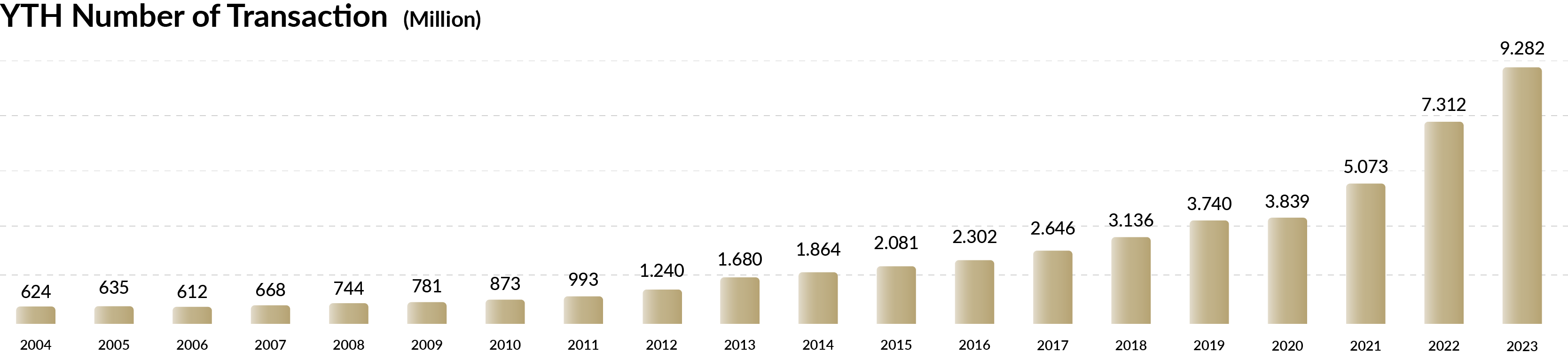

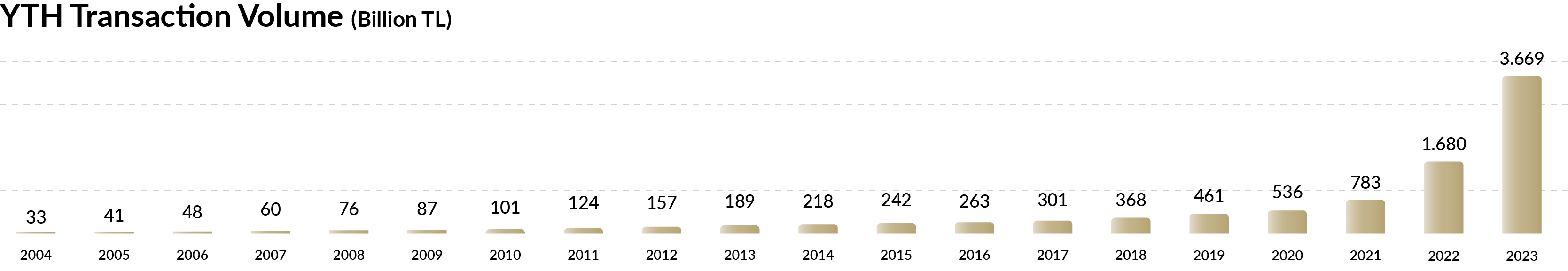

YTH System Statistics

Yearly transaction volume that was processed by YTH System has reached to 9 billion and yearly transaction volume has reached to 3,6 trillion TL.

In 2012, Debit Card clearing transactions were included in the YTH System.

Yearly transaction volume that was processed by YTH System has reached to 11 billion and yearly transaction volume has reached to 7,2 Trillion TL. In 2012, Debit Card clearing transactions were included in the YTH System. In 2004 average transaction volume was 53 TL, and has increased to 673 TL in 2024.

As of 31/12/2024;

-

What are the Criteria for YTH Participant Acceptance?

In order to be a Participant of YTH System,

- A bank, subject to current Turkish banking law and other Turkish legislation related to banking, which issues or plans to issue cards under its name or concludes or plans to conclude merchant agreements and has obtained “necessary permits” from competent authorities,

or

- An institution, which is a member of at least one of the card system organizations and plans to operate within the context of Bank Cards and Credit Cards Law, No. 5464, and has obtained operating license from competent authorities for that purpose,

or

- An institution, which is a member of at least one of the card system organizations and plans to operate within the context of Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions Law, No.6493, and has obtained operating license from competent authorities for that purpose,

must have BKM Membership and meet administrative, technical and financial requirements.

-

How does YTH System operate?

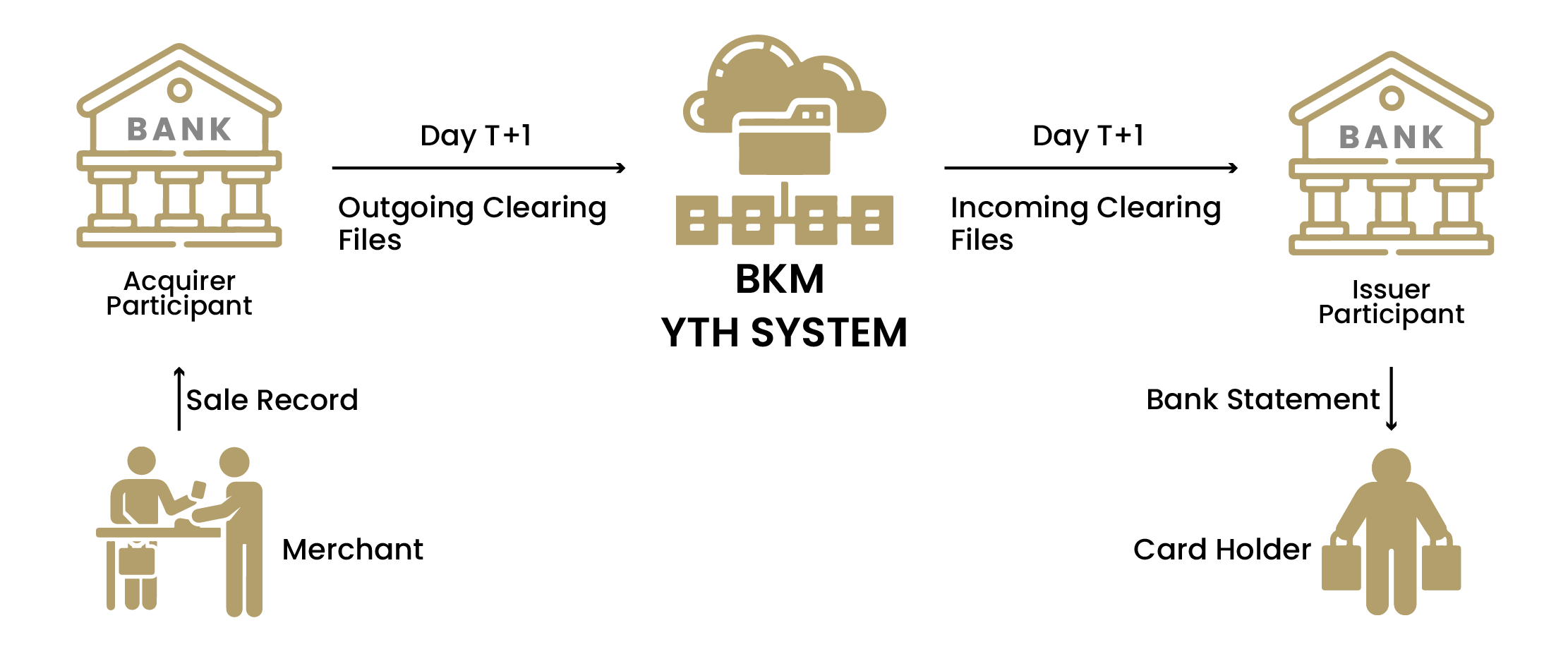

The System works in 3 steps;

1. Clearing;

For a sale transaction that takes place in a merchant, the merchant sends all the sale records to Acquirer Participant at the End Of Day Report. Acquirer Participant sends the records to BKM with “Outgoing Clearing File”. BKM processes all the “Outgoing Clearing File”s received from all System Participants via YTH System, and prepares “Incoming Clearing File”s for Issuer Participants and sends the files to the Issuers.

2. Multilateral Netting:

Multilateral Netting is a process step where one Participant’s credits and obligations to other participants due to records received and sent via YTH System are detucted to calculate one final debit or credit amount.

3. Settlement:

After Clearing and Multilateral Netting, Obligator Participants pay their debts to BKM Account. After receiving all the debts, BKM pays credit amounts to Creditor Participants’ Accounts.

-

What are the working hours for YTH System?

System Participants can send Outgoing Clearing File from 18:00 of previous date to 10:00 of clearing date.

Clearing and Multilateral Netting is processed on the clearing date from 10:00 to 13:30. “Incoming Clearing File” and Reconcilation Reports are shared at 13:30 of the clearing date.

Obligator Participants are liable to pay the debt amount until 12:00 of the following day of the clearing day. BKM pays credit amounts to Creditor Participants’ Accounts by 14:00 of the following day of the clearing day.

-

Who are the YTH System Participants?

YTH Participants

- Ahlatcı Ödeme ve Elektronik Para Hizmetleri A.Ş.

- Akbank T.A.Ş.

- Aktif Yatırım Bankası A.Ş.

- Albaraka Türk Katılım Bankası A.Ş.

- Alternatifbank A.Ş.

- Anadolubank A.Ş.

- Arap Türk Bankası A.Ş.

- AS Ödeme Hizmetleri ve Elektronik Para A.Ş.

- Belbim Elektronik Para ve Ödeme Hizmetleri A.Ş.

- Birleşik Ödeme ve Elektronik Para Hizmetleri A.Ş.

- BPN Ödeme Hizmetleri ve Elektronik Para A.Ş.

- Burgan Bank A.Ş.

- Citibank A.Ş.

- Denizbank A.Ş.

- DGpara Ödeme ve Elektronik Para Kuruluşu A.Ş.

- Dünya Katılım Bankası A.Ş.

- Enpara Bank A.Ş.

- Fibabanka A.Ş.

- Golden Global Yatırım Bankası A.Ş.

- Hayat Finans Katılım Bankası A.Ş.

- HSBC Bank A.Ş.

- ICBC Turkey Bank A.Ş.

- ING Bank A.Ş.

- İyzi Ödeme ve Elektronik Para Hizmetleri A.Ş.

- Kuveyt Türk Katılım Bankası A.Ş.

- Lydians Elektronik Para ve Ödeme Hizmetleri A.Ş

- Moneypay Ödeme ve Elektronik Para Hizmetleri A.Ş

- Nurol Yatırım Bankası A.Ş.

- Odea Bank A.Ş.

- Ozan Elektronik Para A.Ş.

- Papara Elektronik Para A.Ş.

- Papel Elektronik Para ve Ödeme Hizmetleri A.Ş.

- Paratim Ödeme ve Elektronik Para Kuruluşu A.Ş.

- Payporter Ödeme Hizmetleri ve Elektronik Para A.Ş.

- Posta ve Telgraf Teşkilatı A.Ş.

- Pratik İşlem Ödeme ve Elektronik Para A.Ş

- QNB Bank A.Ş.

- Şekerbank T.A.Ş.

- Sipay Elektronik Para ve Ödeme Hizmetleri A.Ş.

- T. Garanti Bankası A.Ş.

- T. Vakıflar Bankası T.A.O.

- T.C. Ziraat Bankası A.Ş.

- T.O.M. Katılım Bankası A.Ş.

- Tom Pay Elektronik Para ve Ödeme Hizmetleri A.Ş.

- TT Ödeme ve Elektronik Para Hizmetleri A.Ş.

- Türk Ekonomi Bankası A.Ş.

- TURK Elektronik Para A.Ş.

- Türk Ticaret Bankası A.Ş.

- Turkcell Ödeme ve Elektronik Para Hizmetleri A.Ş.

- Turkish Bank A.Ş.

- Türkiye Emlak Katılım Bankası A.Ş.

- Türkiye Finans Katılım Bankası A.Ş.

- Türkiye Halk Bankası A.Ş.

- Türkiye İş Bankası A.Ş.

- Turkland Bank A.Ş.

- Vakıf Katılım Bankası A.Ş.

- Vepara Elektronik Para ve Ödeme Hizmetleri A.Ş.

- Vizyon Elektronik Para ve Ödeme Hizmetleri A.Ş

- Vodofone Elektronik Para ve Ödeme Hizmetleri A.Ş.

- Yapı ve Kredi Bankası A.Ş.

- Ziraat Katılım Bankası A.Ş

-

What are YTH System Fees?

1. Inter-Participant Interchange Commissions

Please click here to see Inter-Participant Interchange Commissions.

2. BKM Fees

Participants are charged monthly with a predetermined fee based on the total amount of all financial transactions that pass through the Clearing System.

-

How is the Resignation Process?

There are 2 condition for resignation process

1) Dispersement of Participant

2) Exclusion of Participant

1) Dispersement of a Participant

Participant that decided to disperse the system, have to submit a written application to the BKM. Within 6 days, BKM informs the related parties on this dispersement and excludes the participant from routing services. By the end of the next 4 days, YTH system will start to decline the first presentment transactions of the participant. The participant will be excluded from YTH system and all its’ transactions will be declined after a pre-defined time. The time period will be decided by BKM which cannot exceed 540 days.

2) Exclusion of a Participant

A Participant is excluded from the Routing Services and first presentment transactions are started to be declined by YTH System immediately, if;

- A Participant fails to meet one of the participation criteria and it is aggreed that the participant will not be able to meet the criteria in an acceptable time period

or

- Emergence of risks those may endanger the security and uninterrupted process of the YTH system have been arised

or

- A written instruction from the participant have been received

BKM, immediately, informs the related parties on this exclusion and takes necessary actions to limit the risks on the YTH System. The participant will be excluded from the YTH system and all its’ transactions will be declined after a pre-defined time. The time period will be decided by BKM which cannot exceed 540 days.